Hurricane Coverage Considerations for Homeowners

Personal Insurance

Hurricane Coverage Considerations for Homeowners

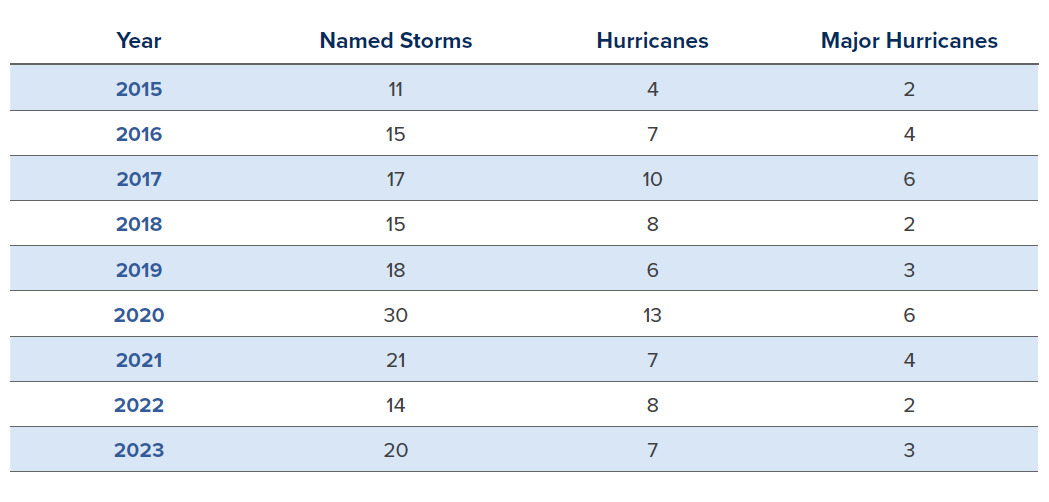

According to the National Hurricane Center, the average year consists of 14 named storms, half of which are hurricanes, three of which become major hurricanes.1

As described in the chart below, major hurricanes continue to spawn out of each hurricane season, with a gradually increasing number of storms each year. 2020 was a record-setting year, with 30 named storms and six catastrophic hurricane systems.

While the Gulf Coast and southeast regions of the United States face the most direct impact from these storm systems, the repercussions echo throughout the country. From Texas to the Carolinas and as far inland as Michigan, insurance carriers are changing their policies and making hurricane-specific deductibles.

Hurricane-specific deductibles were introduced after a catastrophic storm in 1992 and were more widely adopted after Hurricane Katrina. However, over the past few years, the volume and expansion of this deductible has expanded rapidly.

Depending on the company, two different deductibles are typically found on a homeowner’s policy: wind/hail deductible and hurricane deductible. The less favorable deductible is a wind/hail deductible because it is triggered more often and applies when any storm-related event causes damage to the home.

A hurricane deductible only triggers when a named storm causes home damage. Otherwise, any other storm-related activity is called a “no named storm” and would be subject to your All Other Perils (AOP) deductible, typically a flat dollar amount.

Typically, a hurricane claim has an extended timeframe to file a claim, and it varies by state. For example, Florida allows you to file the claim two years from the day the storm impacted your home. At renewal, many excess and surplus carriers have mandated an increase in hurricane deductibles depending on the home’s characteristics. Traditionally, hurricane deductible options are at 2%, 5% and 10% of the dwelling limit. It is less likely to see 3%, and depending on the characteristics of the home, such as location, value, age or hurricane protection credits, some companies will not offer options lower than 5%.

We understand the importance of protecting your home, business and family. Brown & Brown has created several Hurricane Preparation Guides to help you prepare for and navigate unexpected disasters.

Hurricane Preparation and Recovery | Claims Guidelines

Hurricane Preparation and Recovery | Claims Guidelines for Condo Associations

Hurricane Preparation | A Guide for Businesses, Homeowners and Boaters

1 https://www.nhc.noaa.gov/climo/

Graph Source: https://tropical.atmos.colostate.edu/Realtime/index.php?arch&loc=northatlantic