Addressing Rising Workers’ Compensation Claims

Food and Agriculture Case Study

The Request

Help reduce the rising costs and a high frequency of ergonomic-related workers’ compensation claims.

Company Profile

Industry: Food and Agriculture

A large pork processor faced rising costs and a high frequency of ergonomic-related workers’ compensation claims. The company’s risk management team was searching for a solution to develop an ergonomics improvement plan in conjunction with the ergonomic teams in the plant.

The Solution

Assembled and trained an ergonomics improvement team to train employees and identify risks.

The customer worked with Brown & Brown to develop an ergonomics improvement plan. The plan revolved around working with the plant’s ergonomic improvement team, which consisted of key supervisors, employees, maintenance, operations and engineering personnel.

Each team was trained in ergonomic principles, risk factor identification and methods for reducing ergonomic risks. Each month, the improvement team selected jobs with high ergonomic risks and losses and developed corrective plans.

During the three-year process, more than 40 percent of the plant jobs were evaluated and improved.

The Results

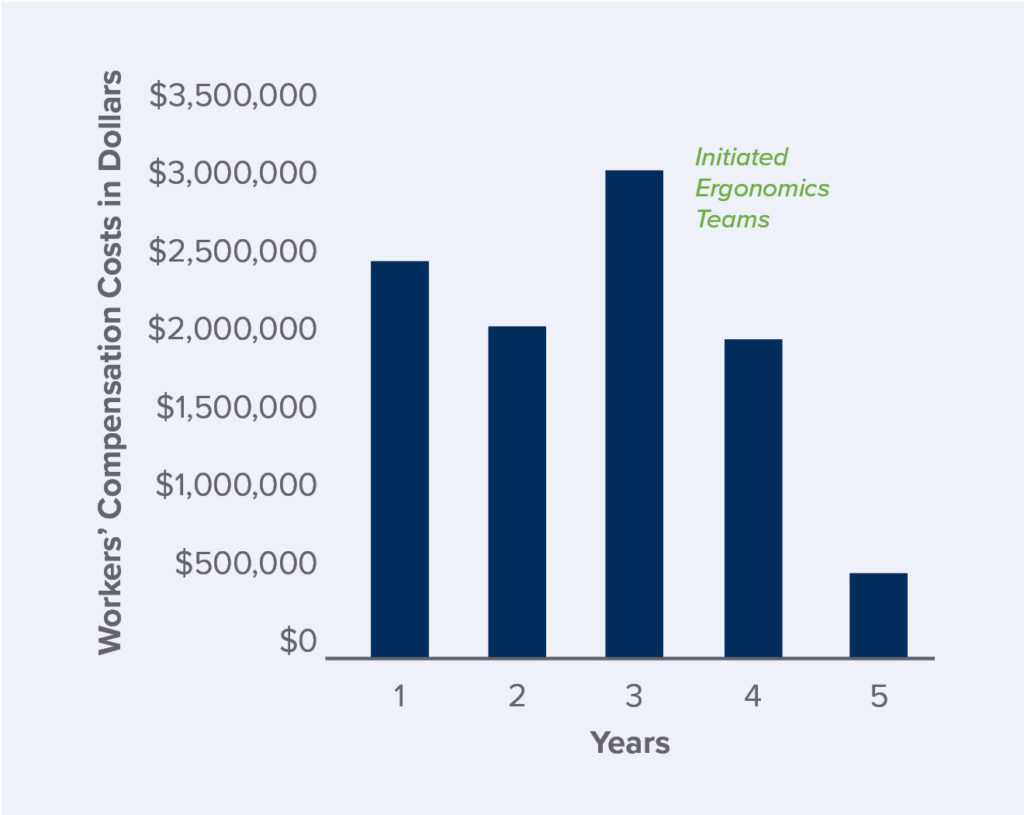

Reduced workers’ compensation costs by 87 percent, from $3,030,000 to $399,000 over a two-year period.

As a result of the improvement plan, the customer successfully reduced its workers’ compensation costs 87 percent, reducing costs from $3,030,000 to $399,000 over a two-year period. The frequency of claims also decreased from 287 to 86 over the same two years, equating to a 70 percent reduction. Brown & Brown specifically helped the company reduce the number of claims in the manual handling and cumulative trauma categories.

In addition to reduced costs and injuries, many jobs were improved from an efficiency and productivity standpoint. This helped enhance the profitability for the company while also creating a safer workplace for employees.

Ready to help minimize your risk and uncertainty?

Contact us for more information.

DISCLAIMER: Brown & Brown, Inc. and all its affiliates, do not provide legal, regulatory or tax guidance, or advice. If legal advice counsel or representation is needed, the services of a legal professional should be sought. The information in this document is intended to provide a general overview of the topics and services contained herein. Brown & Brown, Inc. and all its affiliates, make no representation or warranty as to the accuracy or completeness of the document and undertakes no obligation to update or revise the document based upon new information or future changes.